From Wall Street to Main Street:

Putting Utilities Together with Local and Regional Lending Sources

We provide utilities with syndication advice and transaction structuring in securing debt funding from local and regional banking institutions.

Our utility clients and their stakeholders benefit from an additional diversified and cost-effective source of financing, complementary to money center back-up facilities. They also benefit from community, government, and local goodwill, stemming from an improved local economy and increased job opportunities.

Your Team

An Experienced Utility, Banking, and Regulatory Group >

About CFSD Group:

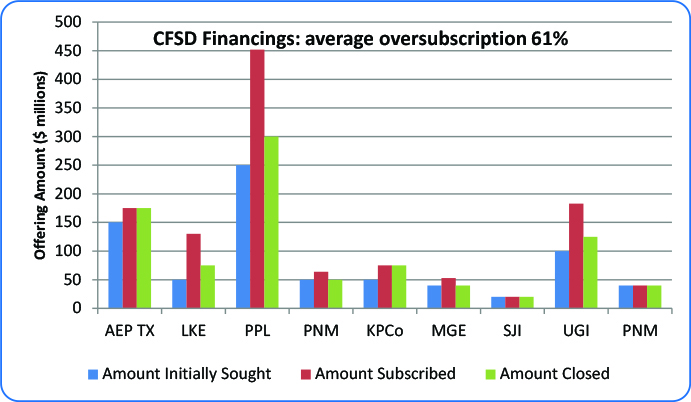

Financings successfully closed

$1.3 billion+

Success rate

100%

Bank participation

11 REGIONAL

125 LOCAL

Notable CFSD Group Transactions:

$40,000,000

$125,000,000

$20,000,000

$40,000,000

$75,000,000

$50,000,000

$300,000,000

$75,000,000

$175,000,000

Private financial advisory

$110,000,000

$94,300,000

Featured Articles:

Fed Won’t Use Stimulus Aid to Push Libor Replacement – WSJ

Fed Won’t Use Stimulus Aid to Push Libor Replacement - WSJ

CFSD Coronavirus Update 5-1-2020

CFSD COVID Financing Paper 5-1-2020

As US utilities prepare for downturn, ‘liquidity is paramount’

As US utilities prepare for downturn, 'liquidity is paramount'

NYT: US corporates draw heavily on revolving credits

MI Citing coronavirus, caution, US corporates draw heavily on revolving credits 3.31.2020 As Virus Hobbles Economy Companies Rac...it and Raise Cash - The New York...

Citing coronavirus, caution, US corporates draw heavily on revolving credits

MI Citing coronavirus, caution, US corporates draw heavily on revolving credits

INQUIRIES: Stan.Garnett@CFSDGroup.com

CALL US: 727-480-0706